Direction for Stock Market in 2007

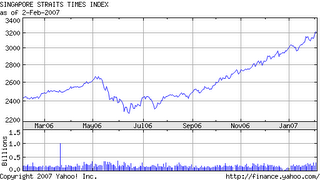

What is beautiful STI chart over the past year!

The index has been moving in a one-way north direction since middle of Jul06 after strugging-ff the sharp correctionsinMay06. The gains have been made at a much steeper pace than in year 2005 and new highs have been broken one after another. We are at a all-time high now at 3,217.68.

The market sentiments are bouyant with expected increased in economic activities and benefits to be reaped from the construction of the two IRs and the recovery of the property markets. Unemployment rate has come down very low and local interest rate has been relatively stable at 3.00 - 3.30% (3-month SIBOR). The listed properties and construction companies have come into life with record volumes traded and prices. Even "dying" construction companies that have been breeding red are "brought-back-to-life" with prices doubling or tripling. This phenomenon was not seen in the run-up in year 2005. I.e. there are alot of expectations and much more speculations involved in the current bull.

The US FED Reserve has paused the interest raise hikes and there are talks that interest rate even be lowered in the 2H. There are alot of expectations that China domestic boom will tag the regional enconomies along. Heng Seng Index has soared to new heights at 20,563.68.

In the midst of all these optimism, there are some lurking dangers like bird-flu, problem with Iraq, Iran & North Korea & sudden terrorist attacks. What about the US trade deficits, protential slowing down of US economy and weakening of US$ than reduce the exporting economies competitiveness. There are also some amount of uncertainties created by the flicker-minded temporary government in Thailand.

Well, as it is now, it looks like year 2007 is going to be a good year for stock market. There are targets of 3400-3500 set for STI by some analysts. However, I believe current bull may lose some stream after the Lunar New Year in late Feb07 and the stronger correction/ profit-taking in Mar-Apr07 after the Singapore Budget. Although there is a potential cut in corporate & personal tax rate that is positive for companies, the increase in GST is likely to cause some slow down in the domestic consumption. Also, stock prices are at very high level now, and profit-taking is bound to set-in at the slightest excuses, especially for the hot-money and hedge-funds.

I'm now more heavily vested in REITs & Business Trusts. Even REITs are supposed to be more stable, we see A-REIT & CMT achieving prices that bring the yield to below 5% compared with the risk-free government bond of 3%. I'm looking to to trim some of the less-quality stocks e.g. AGVA, Tuan Sing & TT International if it can reach my break-even share prices. I'm also looking to take profit on Adampak, Tai Sin, IFS, SPH & SpWindsor. I should be channelling some of the captial to REITs & Business Trusts when the yields are sufficiently attractive again. I will also be looking at foreign listed stocks in New York and London if the prices are fair.