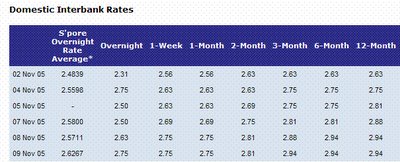

It is apparent that the local interest rates are set to rise in short term in tandem with the US Fed rate hikes, which is expected to last into next year.

Our local interbank rates for 3 months has moved up relatively fast over the past week and it may be a matter of time when the consumers' savings and deposit rates play catching up.

DBS has just raised it's saving account rates and deposit rates by 0.125 to 0.225% recently:

I) POSB SAVINGS ACCOUNT* / POSB PASSCARD ACCOUNT

Existing (% p.a.) New (% p.a.)

First S$3,000 0.125 0.250

Next S$47,000 0.125 0.275

Next S$50,000 0.125 0.375

Remaining bal abv S$100K 0.250 0.475

II) S$ FIXED DEPOSITS (For amounts from S$1,000 to S$49,999)

Periods Existing(% p.a.) New (% p.a.)

1 month 0.175 0.325

2 to 5 months 0.250 0.425

6 to 9 months 0.375 0.575

10 to 11 months 0.500 0.700

12 months 0.625 0.825

18 and 24 months 0.750 0.925

The main point I like to highlight is not about increasing funding cost for a REIT's exisiting funding costs since it can be assumed that an efficiently managed REIT would have hedged it's interest rate risk via fixed/ floating rate swaps, but the higher returns that an investor in REIT would demand since the spread between the current REIT's yield and the bank/ SGS deposits/T-bills/Bonds will narrow in such environment. Since the latter is rather risk-free, an investor would demand a risk premium in a form of spread for REIT. In short, we are likely to see a fall in the REIT's trading price to improve the yield as the interest rates rises, unless the REITs can really further deals that are so attractively priced to improve it's yields.

So, in an increasing interest rate environment, not only the funding costs of REITs may be increased, the investor's demand for DPU yields may also be higher! It's really a time to consider whether to take profit and plough in money again at a later stage when the interest rates stablises.

---------News articles --------

Interest rate rises to impact Reits

Higher dividend yields from property trusts imply lower share prices

Thursday • November 10, 2005

Lim Chung Chun

news@newstoday.com.sg

The United States Federal Reserve has raised interest rates 12 times in the last 18 months, from 1 per cent in June 2004 to the current 4 per cent, and accordingly, interest rates in the US and elsewhere have been rising substantially.

Hence, the five-year government bond yield has gone up from a low of less than 2.3 per cent in May 2003 to the current 4.5 per cent. The yield is currently at the highest level since early 2002.

The 10-year government bond yield has also been increasing, though the rate of increase has been less than expected.

In our opinion, the interest rate yield curve is currently unusually flat. That is, the yields of longer-term maturity bonds are still low relative to shorter-term bonds. Hence there is still room to grow.

In the meantime, what has been the trend of the dividend yields from Reits in the US?

In the 1990s, the dividend yields generally averaged around 7 to 8 per cent. But in the last two years, the dividend yields have declined significantly, and currently stand at slightly above 5 per cent. The decline in yields in the last two years was the result of strong gains in the share prices of Reits as investors chased after this asset class.

In general, rising interest rates are negative for Reits. A key reason is that investors will look to safer investment alternatives as a guide to what to expect from Reits' dividend yields. For instance, if five-year government bonds (considered a risk-free five-year instrument) can provide a yield of 4.5 per cent per annum, investors would expect a return which is significantly more than 4.5 per cent before they find Reits attractive.

Therefore, as interest rates continue to rise, investors will expect increasingly higher dividend yields from Reits. For a given level of rental income, a higher dividend yield from a Reit would imply lower share prices. Therefore, the share prices of Reits will generally react negatively to rising interest rates.

Since the first half of 2003, the dividend yields from US Reits have been declining even as the yields from US government bonds have been increasing. As a result of that, the spread between the Reits dividend yield and the five-year government bond yield has declined to very low levels.

At the current level of spreads, US Reits look unattractive. If interest rates increase further, the share prices of US Reits may start to decline.

For many global property funds, US exposure accounts for about 50 per cent of the overall geographical breakdown. Hence, there is increasing risk for global property funds.

The interest in Reits as an asset class is largely because of the good share price performance of Reits globally as interest rates were low in 2003 and last year. However, the interest rate factor will start to cause the reverse effect going forward, and we advise investors to be conscious of the increasing risks.

The writer is the research director at Fundsupermart, a division of iFAST Financial. He is also CEO and executive chairman of iFAST Financial.

Copyright MediaCorp Press Ltd. All rights reserved.